Avison Young closes $14M sale of Le Jeune Station development site in Miami

Multifamily developer demand rises as Miami sees growth in key industries and corporation influx

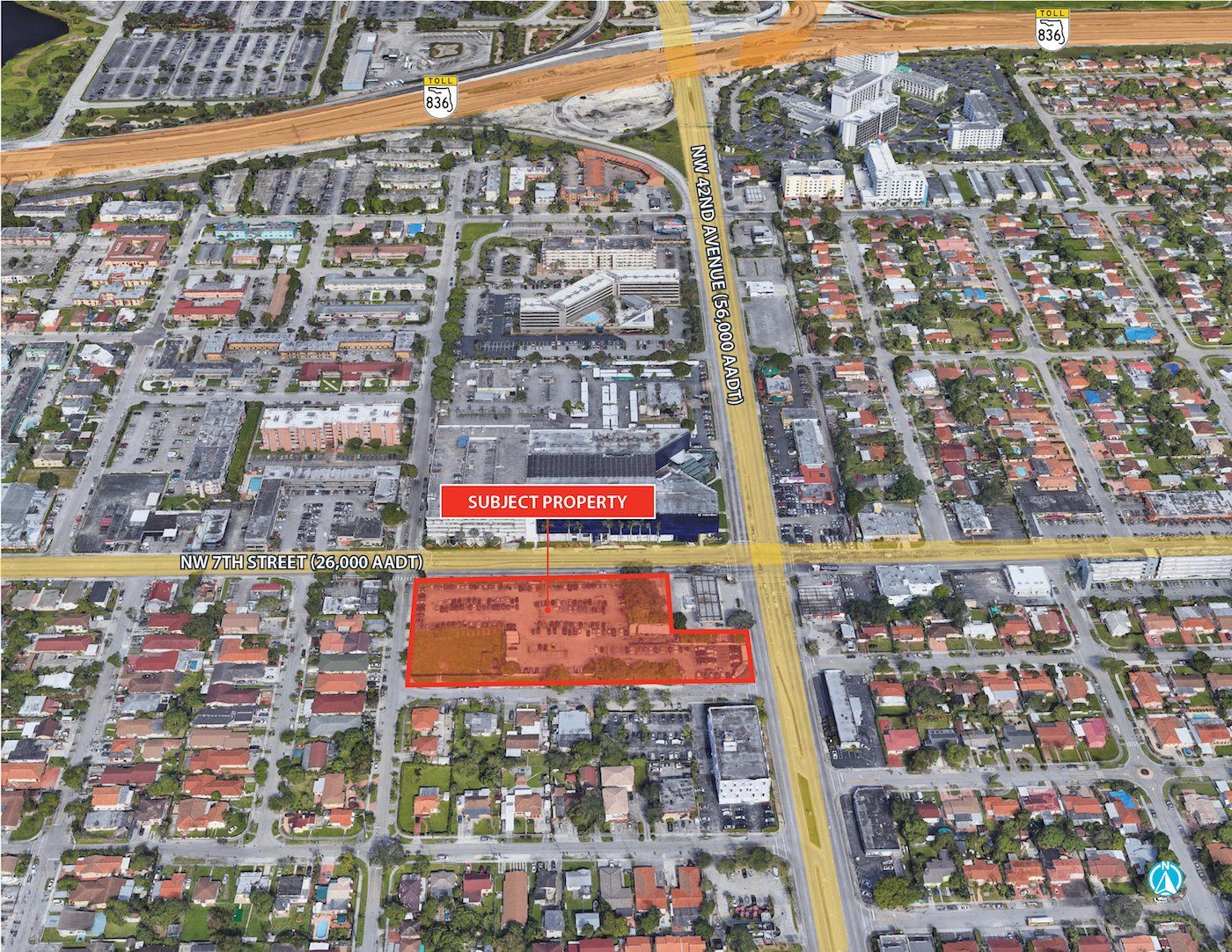

Miami – Avison Young’s Florida Capital Markets Group negotiated the $14 million sale of Le Jeune Station, a ±2.79-acre development site encompassing nearly an entire city block near the Le Jeune Road and NW 7th Street intersection in Miami. The site’s 10-parcel footprint at 4238-42 NW 7th Street represents a mixed-use development opportunity with a zoning mix allowing a total as-of-right density of ±260 units. A successful up-zoned project could boast ±300 residential units and more than 625,000 square feet.

Avison Young Principals John K. Crotty, CCIM; Michael T. Fay, who is also Managing Director of the firm’s Miami operations; David Duckworth; Vice President Brian C. de la Fé; and Associates Emily Brais and Berkley Bloodworth closed the sale on behalf of the seller, Ocean Bank.

“The Le Jeune Station sale signifies continued demand from developers seeking quality multifamily sites in South Florida, as the market has seen growth in key sectors despite the pandemic and has become a magnet for companies and individuals desiring to escape high taxes and population density,” said Crotty. “The site is ideal for an area-defining project due to its prime location along the Le Jeune Corridor, which runs from Miami International Airport to the north and Coral Gables to the south.”

Market research shows that where many U.S. metro markets saw significant rent drops in 2020, Miami’s multifamily rents have remained stable. Despite overall employment losses, several industries have gained jobs year-over-year, such as tech, which saw a workforce increase of 3% in 2020. Avison Young expects Miami rents and vacancy rates to outperform the U.S. average over the next 12-24 months; therefore, developers remain motivated to buy now.